Interview Conducted by: Yang Yang

Translated by: James Choi

Edited by: Elizabeth T. Ploshay

Bitcoin continues to grow in value and BTC China, the lead Chinese Bitcoin exchange and one of the lead Bitcoin exchanges in the world, is expanding tremendously. Bitcoin Magazine received a transcribed and translated copy of Yang Yang of 8BTC’s interview with Bobby Lee, CEO of BTC China and co-founder Yang Linke.

Please feel free to read in English while watching the youtube video below:

http://v.youku.com/v_show/id_XNjMwNjQzOTYw.html

Yang Yang: Hello everyone. Today we are having an interview with the founder of BTCChina, Mr. Yang Linke and CEO Bobby Lee. Would you like to give us a self-introduction?

Yang Linke: Hello. I’m Yang Linke of BTCC. I’d like to express my gratitude for all the support in the past few years.

Bobby Lee: Hello. I’m Bobby Lee, CEO of BTCC. Glad to be here today.

Yang Yang: Thank you both for the interview. Mr. Yang and Mr. Lee, would you give us a brief introduction of the history of BTCC? As we know, it is one of the first exchanges in China.

Yang Linke: I established BTCC in June 2011 with one of my friends who has technical background. We’ve been doing the business for over 2 years. In April this year Bobby Lee joined us and he became the CEO to lead the company.

Yang Yang: Why did you choose Bobby to be the CEO?

Yang Linke: In April of this year Bitcoin saw a rise in its price. The price was so high at that time: more than 1900 RMB. Bobby came to visit me then and he also thought it was a very promising industry. He wanted to work with us to make Bitcoin better-known in China. Our trading platform also improved when Bobby joined us. He has a lot of experience working in multinational companies, which benefits our company a lot.

Yang Yang: It is said that Bobby and Charles Lee, founder of LTC, are brothers.

Bobby: Yes, he is my biological brother.

Yang Yang: You came back to China and joined BTCC. Are you preparing for a global expansion of the company?

Bobby Lee: I actually came back to China 7 years ago and stayed in Shanghai for a period. I worked for a different company for the past few years. My dream was to join the Bitcoin industry and help develop BTCC.

Yang Yang: Mr. Yang, I heard you were in the leather goods business?

Yang Linke: I used to be involved in some projects which were producing equipments for regimen. I also did keep an eye on the Internet. When I came across Bitcoin I thought this was a promising project and didn’t hesitate to participate in it. That was why I established the BTCC platform.

Bobby: Bitcoin is like Internet in 20 years ago. The first time I used the Internet was 20 years ago, when I was at Stanford. I started to use a browser in 1993 or 1994. My major was computer science then, so I had an earlier chance than others to use it. So, today the Bitcoin industry is quite like Internet in 1990s. I always regret that I didn’t drop out of Stanford and start a business myself. I joined Yahoo and worked there for 8 years after I graduated as a MCS. I did gain a lot of experience at Yahoo, and learned how to operate and develop an Internet-based company. When I joined Yahoo, there were less than 500 people, but now it is such a large company. I hope I can also work with Yang Linke to help BTCC grow like this.

Yang Yang: There are many BTC exchanges in China currently. A lot of new exchanges have appeared this year. Your company is now the largest in China. Have you been attacked by hackers in the past?

Bobby Lee: Yes. This last month we were under attack by hackers with DDoS. Since we are now the largest exchange in China, some people attack us on purpose, or just for fun.

Yang Yang: In March of this year FxBTC attacked you verbally, claiming that you attacked FxBTC’s website. Can you explain the background?

Yang Linke: First we didn’t attack FxBTC’s website, and we considered that accusation unfounded. After FxBTC was attacked, they posted on some threads on some forums and branded us as the attacker. As a matter of fact, I didn’t even know how to conduct a DDoS attack. After he posted on that thread, I requested that he take it down and sent him a lawyer’s letter. I didn’t get any reply then, but they did pull off the thread after some time. We can see from this case that the industry is now still a bit chaotic.

Yang Yang: Bitcoin is still a new thing in China. Didn’t you worry about the legal aspects when you established BTCC? A license should have been required then, right?

Yang Linke: We did it just for fun at first. To be honest, we didn’t consider those legal things. But now we’ve already registered in Shanghai and we will comply with regulations in China.

Bobby Lee: Indeed Bitcoin is still in a grey area now in China. Officially speaking it is not legal, but it is not illegal either. I believe policies would be made for Bitcoin in the future. We shall do everything we can to comply with our government and our country.

Yang Yang: That’s why you would like to register in China? So the legal risk is quite high?

Yang Linke: I’d like to have additional comments on this. There are actually a lot of companies in the industry, like p2p loan companies. They are also facing this problem. Some of them have taken steps further than Bitcoin. It would still take some time for this country to understand what is happening.

Yang Yang: What Mt.Gox faces is the US government freezing their account. Right now only the Japanese Yen can be withdrawn from them. So do you think when the trading volume of BTCC has reached a certain level, the government will also jump in? What if the money in your bank account is freezed? Any emergency plan?

Bobby Lee: Mt.Gox is doing business in the USA as well as in other countries. I heard that Mt.Gox did break some laws in the USA. They didn’t get a license when they were dealing with cash business. We’ve already registered in China and we put our customers’ money in a third-party company.

Yang Yang: So what if the personal account of Mr. Yang or other colleagues is frozen?

Bobby Lee: We don’t use personal accounts. We use a corporate account.

Yang Yang: Right. So if your corporate account is frozen, the money deposited by your customers would not be in jeopardy.

Bobby Lee: Yes. Money from our customers should be protected.

Yang Yang: May I ask how much money your customers have deposited in BTCC?

Bobby Lee: We couldn’t answer that.

Yang Yang: Someone also complained that when the price of Bitcoin reached 266USD in April, it was hard to trade in BTCC. When all bids and asks had to be in queue, the matching process took a long time. What was the cause then?

Bobby Lee: Let me answer this question. In April when the price was high, the engine of our system was indeed very slow. You could still buy or sell then, but had to be in queue. It takes around ten minutes to match the bids after you placed an order. Same problem also happened to Mt.Gox, if my memory is correct. The delay in Mt.Gox was more than 2 hours. We’ve perfected our website now so this problem should not arise from now on.

Yang Yang: You are one of the first exchanges here and you did charge a high percent of commission. Why didn’t you put in more money to improve the website?

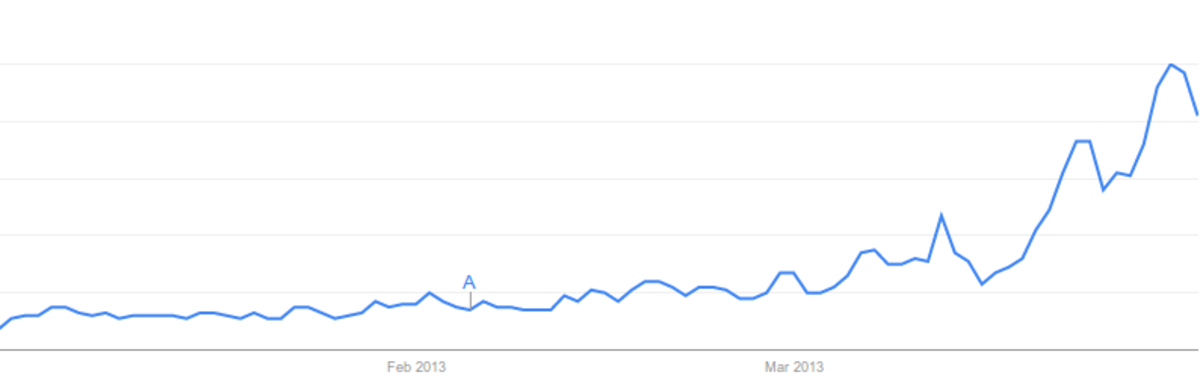

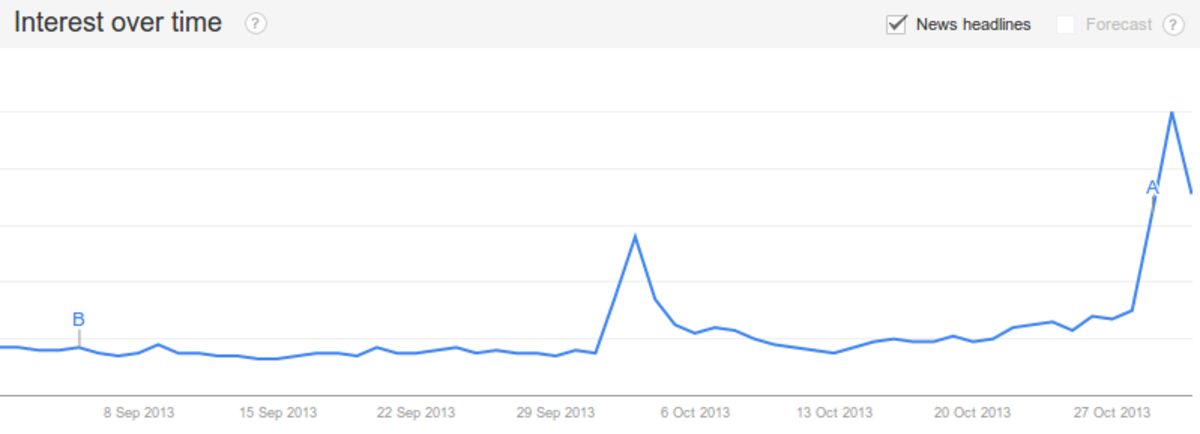

Bobby Lee: Actually we did. We spent a lot of time in the past few months in this area. For example, in the last week the trade volume in our website reached 50,000 BTC, our highest record, which was even higher than Mt.Gox. The record before April was 28,000 BTC, while we reached the level of 40,000 BTC in October. So you can see there were several consecutive days when our trade volume was higher than Mt.Gox. So technically the problem would arise again. But of course the price of your order should be reasonable to be matched.

Yang Yang: There was a fraud recently with an exchange called GBL. Apparently GBL cheated its customers as the company head stole all customers’ money and disappeared. May I know you opinion to it?

Bobby Lee: We don’t know too much about it. But we don’t feel surprised about it. Someone did an investigation about this industry before and concluded that more than half [of the] companies would cease operation within one year. That’s why we keep promising our customers that we are doing a long-term business. In 2011 there were three exchanges while now only one (BTCC) [is] left. You can see there are a lot more exchanges established this year and we believe half of them will disappear. Some may lack proper management and some have malicious fraud. We are always trying to make money by doing the right thing. That’s also what we would like to deliver through this interview.

Yang Yang: Do you have your team of lawyers to deal with questions from outside your company as well as legal issues you might encounter later on?

Bobby Lee: Yes. We have a team specific for this aspect. We are very serious about the political, legal and financial facets. Our principle is to prioritize our nation and our people, and to comply with the laws and policies of our government.

Yang Yang: Is BTCC going to accept other currencies besides RMB?

Bobby Lee: Hard to tell. It depends on the openness of China. Legally speaking, RMB is the only fiat currency in China. We may only accept RMB, as foreign exchanges are complicated.

Yang Yang: Who do you think is your strongest competitor?

Bobby Lee: They must be from traditional industry as Bitcoin wouldn’t just disappear suddenly someday. We are actually competing with ourselves. What concerns us most would be if our customers don’t believe in Bitcoin anymore.

Yang Yang: So you don’t worry about the P2P exchanges? Like Peatio and Bitshare.

Bobby Lee: They might focus on [a] different market. We do keep an eye on them.

Yang Yang: Recently the trade volume of BTCC is higher than other exchanges in the world. Do you think it’s because a large sum of money was pumped into the market or just because of some short-term speculation?

Bobby Lee: Actually in the past few weeks the trade volume did increase. Old users as well as new ones are willing to trade here because we are the most stable, most reliable exchange. So quantitatively speaking, we could have a reasonable guess that the price of Bitcoin in BTCC is now acting as an anchor for [the] global market. Maybe it’s because we don’t charge our customers transaction fees.

Yang Yang: Why did you decide not to charge your customers for transactions? Except for fiat money withdrawal, every transaction including depositing and withdrawing Bitcoin, buying and selling Bitcoin, is now free.

Bobby Lee: We were asked the same question in September. We are trying to promote the Bitcoin business and make it more widespread.

Yang Yang: Or maybe just because other exchanges in China started to avoid charging their customers a fee?

Bobby Lee: We were actually the first one to not charge. After we announced this decision, other exchanges just followed us.

Yang Yang: Your relationship to LTC is close. Do you think that BTCC may accept LTC someday?

Bobby Lee: A lot of people ask us about that. We don’t have any comment on this at this moment, but we will keep you posted.

Yang Yang: As an old Chinese saying goes, a new boss would initiate new reforms. What do you think reforms will aim at?

Bobby Lee: We’ve been working on reforms now for almost half a year. The first thing we did was to register our company in China, so we are now operating in the form of a company. We also improved our technical team and our customer service team. Our next step is to improve the customer experience on our website, since this is what Internet businesses care about most.

Yang Yang: Now many people with larger sums of money don’t trade on these trading platforms. Instead they seek individuals with lots of Bitcoins to trade over the counter. Do you ever consider having VIP service for some VIP customers, so they can get their Bitcoins without influencing the market price? I think that would become a trend.

Bobby Lee: Yes, we did find some customers were trading with a lot of money. The advantage of our website is that the trading volume is quite large, so those people can get their Bitcoins easily without influencing the market price. Actually you can find some accounts trading thousands of Bitcoins in one day, and the market price is staying stable.

Yang Yang: But how can you profit when you don’t make money from customers’ transactions?

Bobby Lee: We earned a lot of money in the past few years. So now we can make a long-term plan, after improving our service.

Yang Yang: Could you reveal me this further plan?

Bobby Lee: I’m afraid not.

Yang Yang: Thank you both for your time. We wish a great future for BTCC.

Bobby Lee: Thanks.