Trace Mayer recently appeared on FOX Business and was asked the question by host Melissa Francis: “Bitcoin is just insane and it has really taken off. People are paying attention to it. But is it for real?”

His response, “Yes, it is definitely for real. I remember the first time I encouraged people to buy Bitcoins it was around a nickel per bitcoin and now it is around $133. So those people who would have followed that advice would have been able to participate in one of the largest bull markets in history and this bull market is not even close to being over.”

[youtuber youtube=’NM32O5YqgdY’]

Why is this bull market not even close to being over?

SELLER’S REMORSE

Price discovery is always an interesting phenomenon. There are always bulls and always bears. The scoreboard is kept in profits and is the only opinion that matters.

The next decades, and particularly six months, are going to be extremely exciting with the bitcoin price. You may be tempted to sell but seller’s remorse is a terrible feeling. You have done the analysis, taken the risk but then to sell out before the vast majority of profits just leaves a particularly bitter taste in one’s investing mouth. It is even worse than just missing the opportunity.

After all, who wants to be like the Litecoin trader with seller’s remorse? One guy wrote a sad tale on Reddit about how in January 2013 he bought 80,000 litecoins at $0.068 and sold them at $0.20. Litecoins reached $5 before moving down to around $3.5 today. So he realized a 194% return, or $10,560, but missed out on a 7,250% return, or $394,560 and is feeling seller’s remorse.

Kind of the opposite of David Choe who could have gotten a few thousand dollars for painting a mural at Facebook but instead got stock that turned into $200m. You have to be in it to win it!

WHY THE BITCOIN PRICE IS MELTING UP

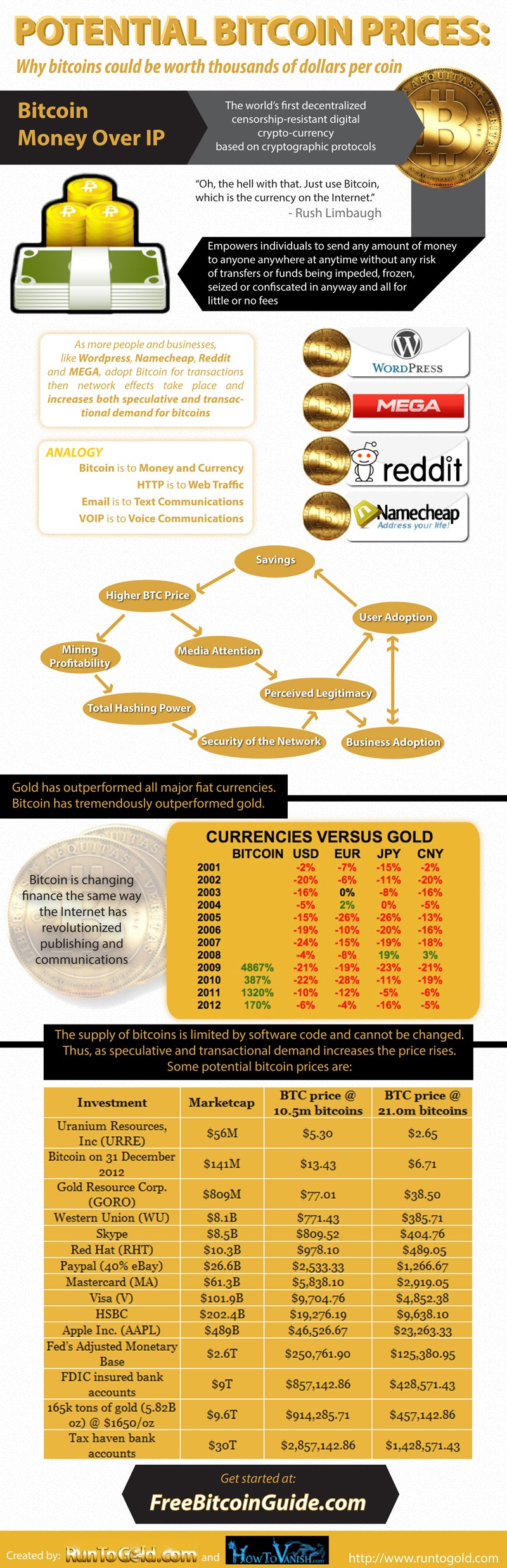

In financial terms, a price can ‘melt up’ when it is significantly undervalued. I wrote about this Bitcoin price melt-up starting on 21 March 2013 and predicted ‘I think a fair value price for bitcoins is around 3-7 bitcoins per ounce of gold.’ With the ratio currently at about 10 bitcoins per ounce of gold; that prediction may turn out to be overly conservative and now we are seeing it happen.

Then we have financial fools like Michael Pento, others who have not been around the Bitcoin market very long and still more who have not done very much substantive due diligence except to reference the bitcoin price chart and all of them loudly proclaim there is a Bitcoin bubble.

But they missed out on the previous large gains in the Bitcoin price and they know it by looking at their own balance sheets. Scoreboard! So, why would any rational bitcoin holders lend them any creditability?

Instead, how about we freshly analyze the state of the Bitcoin economy and then apply where the price could go and then come to a conclusion on what long-time members of the Bitcoin community should do to profit the most. Scoreboard!

First, we have little scrappy run of the mill Bitcoin investors like Jeremy Liew making outlandish statements like ‘In all the scenarios that I’ve painted above, Bitcoin prices need to go up by 100x or more.’

So who is Jeremy Liew? Well, he was named to the Forbes’ Midas list in 2011 and 2012, has received an MBA from Stanford and is a Partner and managing director at Lightspeed Venture Partners which has backed over 200 companies and is currently investing out of a $675m fund and recently wrote an article for TechCrunch titled Why VCs Love The Bitcoin Market.

And you think Jeremy Liew is alone among his Silicon Valley VCs and Wall Streeters?

How about Adam Draper, an established VC, who will ‘incubate 5-7 Bitcoin related companies in our next batch‘. Why? The reasons stated earlier are: (1) increased investor confidence in the Bitcoin protocol, (2) reduced legal uncertainty from FinCEN guidelines, (3) Cyprus bank deposit seizures, (4) current adoption by large tech companies like WordPress, Reddit, Expensify and Namecheap and (5) the rising price where he stated ‘My prediction – Bitcoin hits $225 by August.’

And how about Fred Wilson a principal of Union Square Ventures who made a crap-ton of profits backing Zynga, Twitter, SoundCloud, Meetup, Foursquare, Etsy and plenty of others. Over a year ago, when prices were around $5, he wrote, ‘I’ve mentioned Bitcoin a number of times on this blog. It is something our firm is watching closely.’ And what do you think he has been doing over the past year? Right, just twiddling his thumbs watching the Bitcoin juggernaut gain financial mass and transactional momentum.

And how about the recent frontpage article in the Financial Times? The relevant passage: “Some finance industry entrepreneurs have leapt at the opportunity. Exante, a Malta-based asset manager, set up a Bitcoin fund last year that was largely intended as a fun punt. Wealthy investors each put in $1,000 when Bitcoins were trading at $13 on the understanding they could lose the original investment. Exante predicted that public and media interest would take off when Bitcoins were trading at $100. Managing partner Gatis Eglitis claims they are now getting 20 calls a day from large asset managers looking to invest up to $100m.”

Plus, most of the VCs and Wall Streeters including in my opinion Mr. Liew, Mr. Draper, and Mr. Wilson, do not really know what is going on in the Bitcoin economy and are operating on incomplete data. As I explained to one of Mr. Wilson’s associates, all they really see is the tip of the iceberg because of Bitcoin’s increasing role as a settlement currency. If they could see the full iceberg then the feeding frenzy would really get crazy.

But people like Roger Ver, long-time Bitcoin advocate, knows what is going on and is willing to put his money where his mouth is as evident from this 4 Aug 2011 video where offered to make a $10,000 bet that Bitcoin would outperform either gold, silver, the S&P 500 or the USD by 100x over the next two years.

[youtuber youtube=’http://www.youtube.com/watch?v=gfydIbhduu0′]

At the time of his bet gold was trading at $1,664.25, silver at $41.62 the S&P 500 at $1,200 and bitcoins at $9.26. Currently gold is trading at $1,580.70, silver at $27.12, S&P 500 at $1,553 and bitcoins at $160.00. So, only the S&P has outperformed the USD with a 29.4% return compared to bitcoin’s 1,633% return or 55.5x the S&P 500’s return.

It will be interesting to see whether Roger Ver’s prediction comes true within the next four months. Assuming the S&P 500’s return stays the same at 29.4% return then the approximate bitcoin price will need to be around $270. But anyway you analyze it the bottom line is clear: Those who followed Mr. Ver’s advice would have profited greatly!

The bottom line: there are a ton of funds flowing into Bitcoin. And nothing could be more exciting for the bitcoin price than a feeding frenzy of well capitalized financial sharks in a market as tight as Bitcoin who then have a financial incentive to build out the infrastructure that will enable greater adoption, hyper-monetization with Bitcoin ‘going viral’ as a currency (the opposite of hyperinflation) and the accompanying network effects.

Second, the economic characteristics of Bitcoin are like a Giffen good which inverts the traditional supply and demand effects. With Bitcoin the supply is fixed and known to all market participants. However, what is unknown is the float that is available for sale; which I will get to later.

There is only transactional and speculative demand. For transactional demand the price is irrelevant. So that simply leaves speculative demand. And since Bitcoin is a Giffen good that is produced only to be hoarded and not consumed therefore it has a paradoxical effect: As the bitcoin price rises it decreases float supply and increases demand.

The bottom line: You better strap yourself in and make sure your bitcoins are in cold storage because this price discovery is going to be a ‘4G inverted dive’ that may cause you to blackout thinking you are lucid dreaming because the traditional ways of analyzing this Bitcoin market and its players are inverted. I would tell you but the ‘Bitcoin gods’ have deemed it classified.

[youtuber youtube=’http://www.youtube.com/watch?v=wUZxSf_P2r0′]

HOW TO MAXIMIZE YOUR RIDING OF THIS BULL MARKET

A rise in the price of bitcoins represents a wealth transfer from holders of some other assets to holders of bitcoins. Having been involved in Bitcoin for such a long time and having known, worked with and strategized with so many people therefore I really hope the Bitcoin community gets to benefit from this massive upcoming wealth transfer and not sell out early like the Litecoin trader.

[youtuber youtube=’http://www.youtube.com/watch?v=X4d_29vJlB4′]

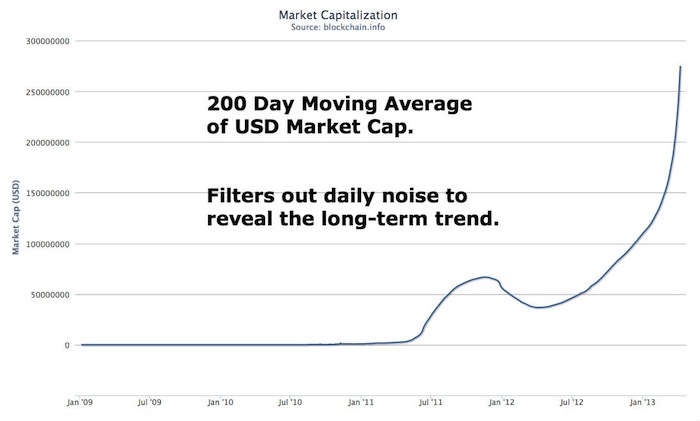

The long-term trend of Bitcoin is extremely positive. I like to look at the 200 day moving average to filter out the daily noise.

To maximize your profits from this long-term secular crypto-currency bull market you merely need to (1) hold onto your bitcoins, (2) restrict supply as much as you can (this is very important!) and (3) make any of these newcomers, like the VCs and Wall Street sharks, pay extremely dearly for whatever trickle of bitcoins you do choose to spend. Notice I said spend, like buying a new Porsche or one of 500,000+ products from the Bitcoin Store, and not sell as in like USD, EUR, etc.

Currently, there over 14,500 people waiting for MtGox verification of their trading accounts and if they are looking to use Bitcoin as a transactional currency for purchases from BitSpend or Silk Road then the price is irrelevant to them. And then we have a ton of Silicon Valley VCs and Wall Streeters fighting over each other to establish multi-million dollar positions. But that amount of capital is going to look tiny compared to what is scheduled in about six months.

There are only about 80,000 bitcoins of ‘float’ on a daily basis. Remember, prices are set at the margin. Simplistically and only for an example in aggregate, this means that if there is a positive funds flow into bitcoins of about a mere $4m then it will move the price by about $50. So, obviously, if there are any large blocks of bitcoins, ‘walls’, are gobbled up extremely quickly by this hot money from VCs and Wall Streeters. If that float can be reduced from 80,000 to 40,000 then the same $4m will move the price $100. That means VCs and Wall Streeters will have to pay more dearly to get any bitcoins. Squeeze them for all they are worth!

And if you start acquiring bitcoins on a regular basis, as a service provider or merchant and are using a service like Bitpay then increase the percentage you hold as bitcoins or you can regularly buy bitcoins with a percentage of your paycheck to further dry up any other supply.

Solution: Remove the walls and dry up any other supply of bitcoins.

CONCLUSION

You know what’s cool? A $150 per bitcoin? No, a $1m per bitcoin. It may take a decade to get there but the fiat currency market coupled with fractional reserve banking is the largest bubble in the world and since the Great Credit Contraction has started along with Bitcoin being a censorship-resistant honey badger of a currency it just may eat these bankster cobras.

After all, the Bitcoin market, at current prices, is simply far far too small for these amounts of fund flows and is the key reason why the VCs and Wall Streeters are melting up the price by buying any bitcoins that appear for sale. Plus, saving bitcoins is where the virtuous cycle begins.

And for those who think there is a massive Bitcoin bubble. The last bubble went from $0.05 to about $32 and unlike so many who are calling this a bubble I know what it felt like back then because I was there. For a comparable move the bitcoin price would need to move from about $5 to around $3,200, a 20x rise from current prices, and we are only about 5% up this ‘wall of worry’. And like usual, Scoreboard, because we are playing this game for financial keeps:

[youtuber youtube=’http://www.youtube.com/watch?v=KPxDoFbsvWA’]

TARGET ACQUIRED: TARGET LOCKED