Only six months after the Bitcoin price last reached an all-time high of $266 in April, Bitcoin is shooting up yet again. The rise started almost immediately after the beginning of October, when the anonymous market Silk Road was shut down and its owner arrested; although the price did drop down from $127 to a low of $85 on Bitstamp, it recovered quickly, and soon started rising from $127 at an average rate at over three percent per day. After a brief crash and consolidation at $200, Bitcoin kept rising again, and soon finally hit its new all-time high.

First of all, what is different between the post-crash period this year and that in 2011? The main answer is, this time the recovery came much more quickly. While in 2011 the Bitcoin price kept steadily dropping for over five months, losing over 93% of its value compared to is peak before finally starting a slow and arduous recovery that would last all the way through 2012. Here, the situation was different. The price dropped to a low of $50.01 on MtGox a mere three days after the spike to $266 and the subsequent crash; if one could anthropomorhize the mind of the market at the time, we might hear something like “yeah, we know the price is going to crash hard, let’s get it over with already”. From there, the market quickly recovered, and although a more protracted two-month-long secondary slump did follow, the price never again fell below $65. Why did this happen? Essentially, the market was more experienced. Many of the market participants had already been through the hard crash in 2011, and knew exactly what was going to come.

What is more interesting, however, is the peculiar characteristics that make this rise different from the last. The first difference is one that is subtle, and difficult to quantify in terms of statistics. And that is this: the rise from December 2012 to April 2013 was marked by a flurry of positive news in the Bitcoin ecosystem. WordPress started accepting Bitcoin in November, Bitcoin Central made a first-of-its kind deal with a licensed payment processor in France in December, and January saw a flurry of positive news around the Bitcoin gambling industry. Finally, during February, the month during which the price made its last leg up before crossing the $31.91 peak that it set back in 2011, the list of Bitcoin-accepting businesses was joined by Mega and Reddit, and the internet Archive became the most prominent organization to pay its employees in Bitcoin.

What do we have today? Essentially, Baidu Jiasule. So in what specific ways is the Bitcoin ecosystem better today than it was six months ago? Essentially, the answer is a subtractive one: the Bitcoin ecosystem got rid of risk. In May, everyone was concerned about the regulatory consequences of the FinCEN guidance detailing legal guidelines for Bitcoin users and exchanges. Since then, however, many countries around the world have clarified Bitcoin’s tax status, Germany gave Bitcoin official recognition as a private currency, and even China and India had government officials come out to say that they do not intend to regulate Bitcoin for the time being. The other major risk factor that the Bitcoin ecosystem lost was economic centralization. In April, MtGox had over 70% market share in the Bitcoin exchange industry, BitPay was by far the largest payment processor, and the Bitcoin drug market, which many thought was crucial to the Bitcoin economy, was dominated by Silk Road. Since then, MtGox’s market share has been eclipsed by those of Bitstamp and BTCChina, BitPay has been joined by Coinbase, to a lesser extent BIPS and now Circle, and at the beginning of October the last point of vulnerability, Silk Road, was shut down – and Bitcoin’s prices soon went up rather than down. Today, the only centralization that remains is a technical one: the monopoly of the bitcoind source code, and even that is open-source and governed by a semi-public development process.

This rally is also different from the last in terms of technical analysis. The Bitcoin markets, as well as many other markets, follow very clear patterns. The most common of these is the concept of a psychological threshold. This graph shows quite well the general effect:

Here, the price reached a level slightly below 30 USD, fought against the threshold for days, and then finally breached it and entered a minor bubble up to 31.3 USD, before crashing and consolidating slightly above 30. Threshold effects can happen in two places: at psychologically significant numbers (eg. $30, $200), and at previous peaks. So what is different now compared to then? Then, these effects took place entirely on MtGox, and the other exchanges closely followed MtGox’s behavior. This time, there are three major exchanges: MtGox, Bitstamp and BTCChina, and each one has a life of its own. Here are BTCChina’s battle against 1000 CNY:

And 2000 CNY:

And here is the rise of the Bitstamp price from $180 to $230:

Here, notice how the Bitstamp price actually broke two successive thresholds. First, it spent days breaking through the peak of $206 that it made before its brief crash to $160. Soon after it does, however, once can also see another, smaller plateau lasting only a few hours. This is actually the BTCChina price brushing up against its own peak of 1339 CNY.

What this means is two things. First, there are far more thresholds that the Bitcoin price will need to break through, and not all of them will be obvious. We may see a minor battle as MtGox brushes against a certain price threshold, and then another larger battle as Bitstamp hits it a day later, and then BTCChina force a consolidation after approaching a round number measured in Chinese yuan. Second, the effect of each threshold will be lower. North American and European speculators may be excited about the prospect of Bitcoin hitting 1000 USD, but for Chinese users the threshold is much less interesting; they are more closely watching for Bitcoin to break 10000 CNY (~$700). This also creates opportunities for clever inter-exchange speculation; if the price on BTCChina breaks through 10000 CNY, it may be difficult to buy on BTCChina quickly enough to take advantage of this, so it may instead be a viable strategy to buy on Bitstamp and MtGox at that time. This threshold weakening effect will have an unknown effect on Bitcoin pice growth in general; it may cause prices to rise faster by reducing barriers, but it may also more quickly create the conditions for a large crash.

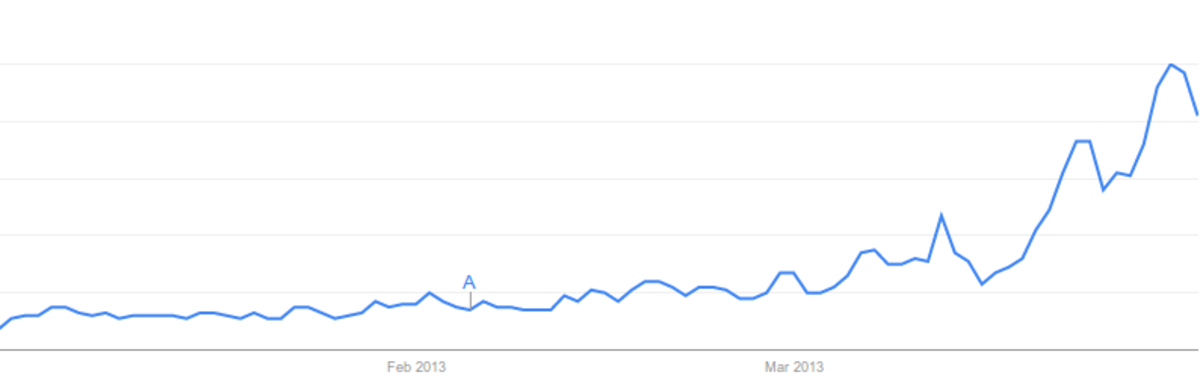

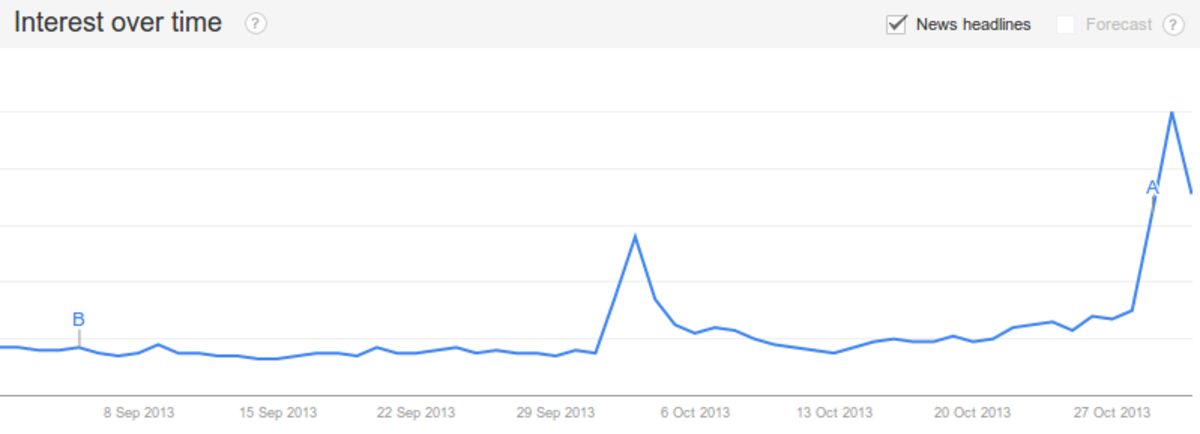

In what ways is this rally just like the last? Largely, it’s a matter of the precise nature of the correlation between price growth and media attention. Earlier this year, the growth in price preceded the growth in Google Trends volume:

And this year the situation is the same:

What does this mean? Essentially, that media attention on Bitcoin is largely caused by Bitcoin price rises, more so than the other way around. The effect is certainly a positive feedback loop, with both effects supporting the other, but price rises come first. Of course, there is one alternative explanation – that people inside the media companies know that they are going to write about Bitcoin ahead of time, and thus buy up bitcoins beforehand, but the fact that this effect has survived even as media organizations in the US, Europe and China are now reporting on Bitcoin suggests that it is not too likely to be taking place to a significant extent.

Welcome to the third great Bitcoin bubble; we certainly do live in interesting times.