On 26 March 2013 the renowned BBC Newsnight produced a 9:20 segment for about 700,000 viewers on the new decentralized virtual currency Bitcoin. Veteran journalist Jeremy Paxman hosted Daniel Knowles, a writer for The Economist, and Trace Mayer of Run To Gold and How To Vanish.

Being a professional journalist myself, although mostly contained to the written word, I know how difficult it is to research a story, craft an engaging script and then produce a segment all under the extremely tight deadlines imposed by current events. Being a long-time fan of the BBC, it must be the accents!, I jumped at the opportunity to provide the counterweight in the Bitcoin segment and am grateful to the very professional team at the BBC that made this segment a well produced piece of content. And having it follow the hair raising piece on the Cyprus debacle shows they have an open mind towards a potential solution for their viewers.

[youtuber youtube=’UA5_paH__q0′]

BACKGROUND

In this case and under the circumstances, I think the BBC produced a fine piece on Bitcoin. There are some within the Bitcoin community who are constantly impugning the motives of the professional media outfits. But with regards to this piece I hope some background information may be found useful.

With the bank seizures in Cyprus coupled with recent FinCEN guidelines being issued for decentralized virtual currencies there has been a flurry of activity in the Bitcoin price which makes for a very compelling story. But Bitcoin is extremely complicated. And to make matters worse, it seems that many of the knowledgeable voices on the subject have spent too many of their bitcoins on Silk Road instead of saving them.

On 25 March I was freezing in London and headed to Heathrow so I could join some people for an event in the Southwest United States and since I had a few days free in the schedule preferred to spend it in the sun instead of the frigid drizzle. Around 10:30am I received a call from a blocked number, which I normally do not take, but because I had been tipped off that the BBC may call therefore I answered. They were crafting a Bitcoin story, looking for a proponent and after some conversation I was battlefield promoted to backup.

You see they wanted someone in London, where ironically I had just been, to be live in studio. Plus, it would have been a higher quality piece of content, technically more controlled and were working under an extremely tight deadline with this very complicated subject matter. Had I known I would have extended my stay in London a couple days to accomodate them since I am such a fan of the BBC and this would be my first appearance. But we are all played the cards we are dealt and while they searched for someone local I told them I would be as flexible as possible as a backup.

But finding high quality and reliable guests is difficult! So a few hours before airtime I got the call and began making the 45 minute drive to the remote studio. Once there the studio had some technical difficulties so the poor BBC staff had to make several contingency plans and modifications. I am sure the uncertainty was problematic for scheduling. But about three minutes before airtime the technical difficulties got resolved and it was go time. The show must go on.

And it did go on and I think turned out pretty well all things considered.

REBUTTALS TO MR. KNOWLES

It is evident that Mr. Knowles has done significant research on Bitcoin. He raised a few issues that it would have been nice to respond to. However, given the remote studio nature of the appearance and time constraints that made it impossible to do on air without potentially disrupting the show in an unprofessional manner. So, I suppose this will have to do.

First, For money laundering Bitcoin is not a very useful tool, compared to others available, and that activity is largely kept within the fiat currencies like USD and EUR anyway. Even the European Central Bank’s Bitcoin report concluded on page 25, ‘Therefore, the real dimension of all these controversies [money laundering] still needs to be further analyzed.’

Users should keep in mind that Bitcoin is not anonymous by pseudo-anonymous. Additionally, all transactions are permanently stored in the blockchain which anyone can review. This leaves a tremendous amount of digital footprints that a competent forensic accountant can follow.

Consequently, I think Mr. Knowles is attributing to Bitcoin’s censorship-resistant nature a property which it does not have. Just because a payment cannot be stopped does not mean it cannot be traced.

Second, Bitcoin is not deflationary because inflation is an increase in the money supply and deflation is a decrease in the money supply. With Bitcoin there is a predictable amount of new bitcoins issued on a regular basis, currently 25 bitcoins about every six minutes. Therefore, Bitcoin is inflationary.

So, I am not sure what Mr. Knowles criticism is since it is premised on a substantively incorrect premise and misstatement of fact. Perhaps he can rephrase it?

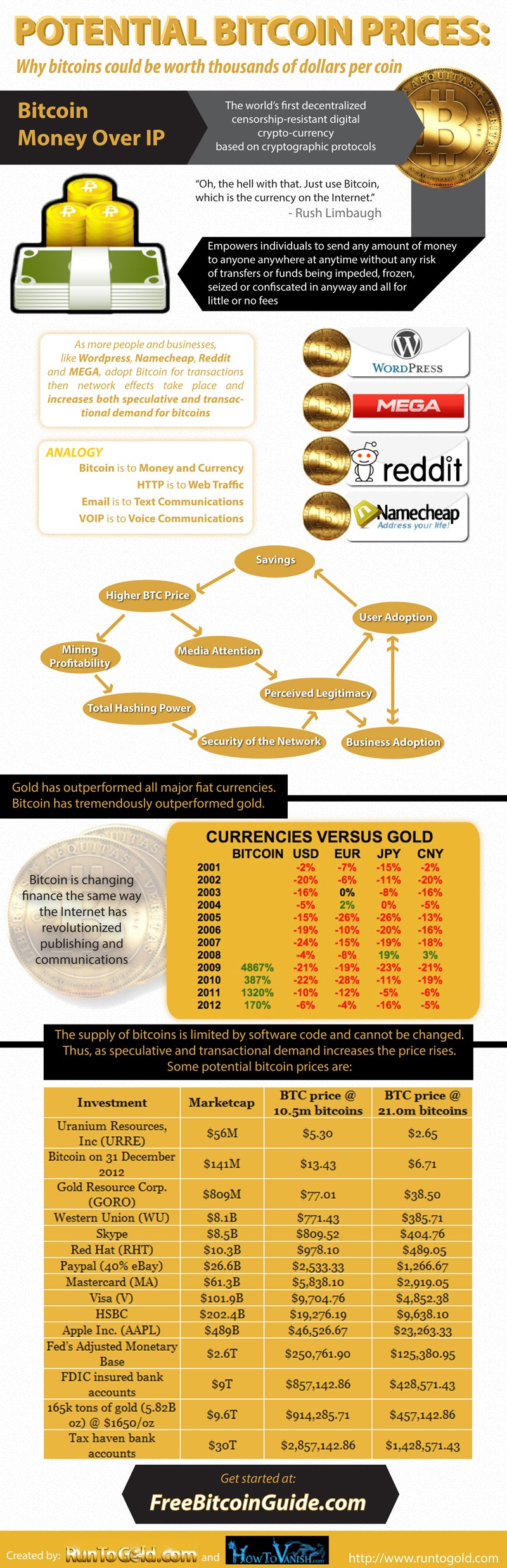

Third, I am not sure I understand his criticism about why it is bad for one’s savings to increase in value. As illustrated in an infographic I put together on potential Bitcoin prices the saving of bitcoins is the starting point of a virtuous cycle for the Bitcoin economy.

Plus, for those of us who have been saving bitcoins, unlike Mr. Knowles who if he is saving at all is doing so in a fiat currency that is constantly losing purchasing power, those in Bitcoinland have a lot more wealth to spend on consumer products and as Bitpay’s recent records show, with $2m of transactions processed in March, those bitcoins are being spent. And that increased wealth is the result of a massive wealth transfer that is benefitting holders of bitcoins.

Fourth, the size of the Bitcoin money supply is starting to get pretty substantive in size and larger than about 40 nation states. It seems Bitcoin nation is growing. For example, the Central Intelligence Agency’s World Factbook would place the Bitcoin money supply around the 150th largest nation.

| COUNTRY | M1 | BITCOIN PRICE |

| Rwanda | $673,200,000.00 | $61.65 |

| Montenegro | $749,000,000.00 | $68.59 |

| Fiji | $794,600,000.00 | $72.77 |

| Djibouti | $798,100,000.00 | $73.09 |

| Turkmenistan | $828,800,000.00 | $75.90 |

| Aruba | $868,500,000.00 | $79.54 |

| Togo | $954,500,000.00 | $87.41 |

| Bitcoin | $955,000,000.00 | $87.50 |

| Maldives | $974,900,000.00 | $89.28 |

| Congo, Dem. Rep. | $1,016,000,000.00 | $93.05 |

| Niger | $1,064,000,000.00 | $97.44 |

| Cambodia | $1,094,000,000.00 | $100.19 |

| Spain | $775,200,000,000.00 | $70,993.24 |

| United States | $2,318,000,000,000.00 | $212,283.70 |

| European Union | $6,205,000,000,000.00 | $568,257.27 |

| Japan | $6,735,000,000,000.00 | $616,794.96 |